The quicker and less hassle a process is, the more appealing it is to customers. And the financial services industry has been leveraging AI for efficiency for a while now, so what’s different today?

Generative AI. It transcends mere automation. It goes beyond just interpreting data and generates unique outputs, unveils hidden patterns, and even predicts future outcomes. This opens doors for previously unimaginable applications in fintech.

From credit scoring that goes beyond traditional metrics to robo-advisors offering personalized investment strategies, AI is using data like never before to make financial products and services sharper. In this blog, we explore the most prominent use cases of AI in fintech along with some real-world examples.

Let’s begin with a brief overview of how AI is transforming the fintech industry.

AI’s impact on the financial industry

AI is driving transformation across the financial services industry, enabling firms to unlock new efficiencies, enhance risk management capabilities, and deliver superior customer experiences.

- Conversational AI & Virtual Assistants

Banks now use AI-powered chatbots and voice assistants like Bank of America’s Erica to answer questions, process transactions, and offer help 24/7. They also deploy generative AI (e.g., GPT models) to craft hyper‑personalized marketing messages and draft regulatory summaries on demand.

- Operational efficiency

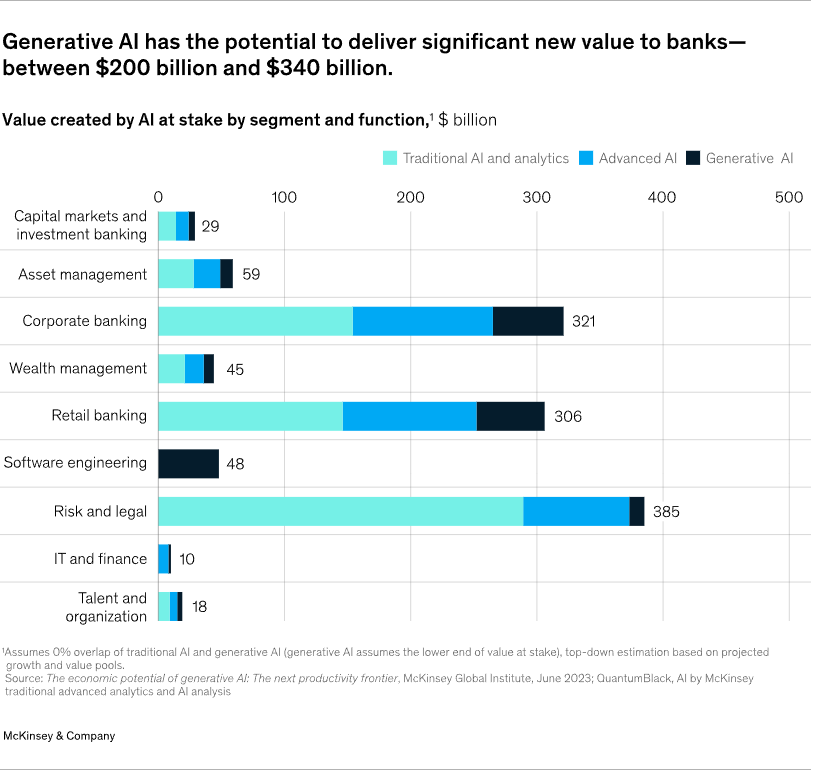

AI significantly reduces operational overheads by automating labor-intensive and repetitive tasks like data entry, document processing, and reconciliation, ultimately leading to cost savings. Banks are most likely to benefit from it. Generative AI is expected to add new value of $200-$340 billion annually (equivalent to 9 to 15 percent of operating profits) for the banking sector.

- Enhanced security

Leveraging AI for real-time fraud detection can prevent losses and boost compliance. American Express’ AI decision engine analyzes over $1 trillion in transactions annually, minimizing fraud.

- Improved decision-making

AI models can process vast amounts of data from diverse sources to make faster, more accurate decisions around lending, insurance underwriting, trading strategies, etc. A Deloitte survey found that 85% of its respondents who used AI-based solutions in the pre-investment phase agreed that AI helped them generate an alpha strategy.

- Personalized customer experience

AI enables tailoring products, advising, and outreach at an individual level based on predictive analytics on customer needs and behavior patterns. This improves engagement and loyalty. Robo-advisors like Betterment provide hyper-personalized investment advice at scale.

This transformative impact of AI in the financial industry is largely driven by a diverse set of AI technologies, which we discuss below.

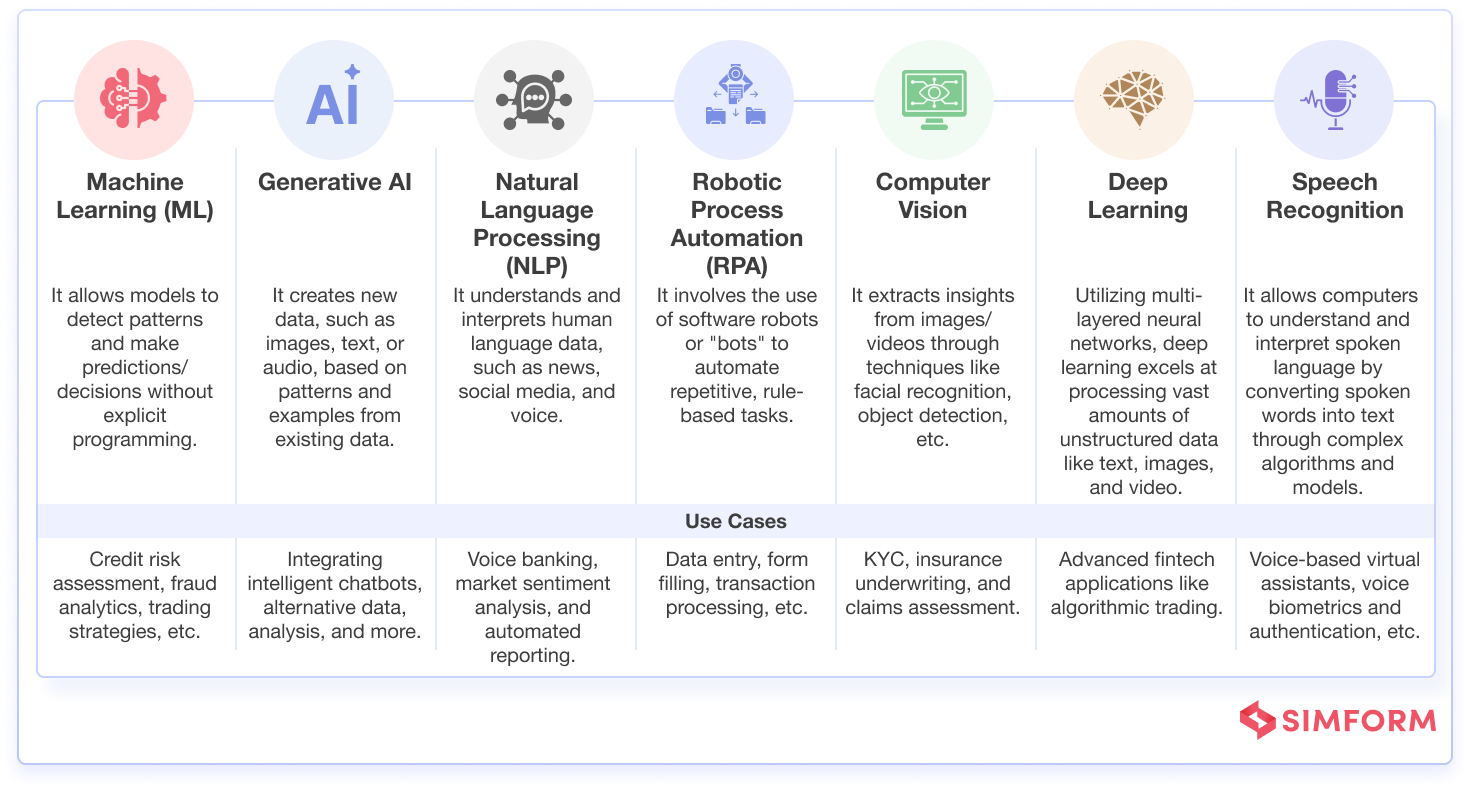

AI technologies used in fintech today

While AI covers a wide range of technologies, here are some of the key ones transforming financial services.

AI in fintech use cases and applications with examples

In this section, we examine the top applications of AI in financial services, with real-world examples of how it is transforming financial processes.

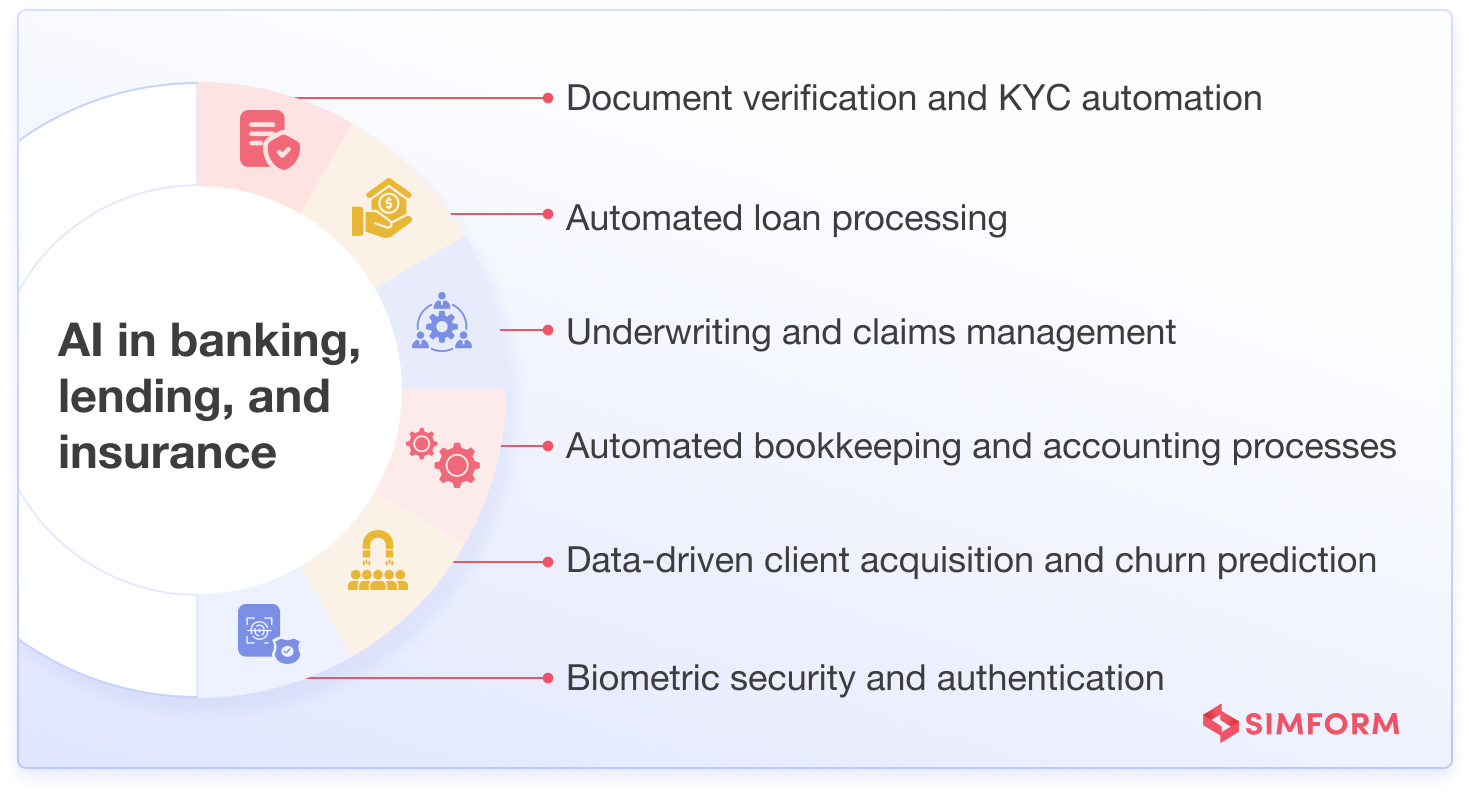

A. Banking, lending, and insurance: Automating operations with AI

1. Document verification and KYC automation

AI is being increasingly used to automate the KYC process, with solutions such as intelligent document processing, digital customer onboarding, and biometric authentication.

- Information collection: AI-powered optical character recognition (OCR)can extract information like ID numbers, names, addresses, and more from identity documents (passports, driver’s licenses, utility bills, etc.).

- Document verification automation: ML models cross-check the extracted data against sanctions lists, watchlists, and other required databases, flagging potential risks or inconsistent information.

- Enhanced screening: Predictive analysis tools can detect doctored or fraudulent documents by analyzing subtle patterns not caught by the human eye.

- Continuous KYC monitoring: Real‑time sanction/PEP screening, adverse‑media alerts, and dynamic risk flags reduce onboarding costs by up to 70 percent and turnaround times by up to 90 percent.

By completing KYC in minutes rather than days, AI technologies significantly reduce costs, minimize errors, and improve customer satisfaction.

For example, Scotiabank, one of Canada’s Big Five banks, uses Google AI solutions such as NLP, Voice, and Vision capabilities to automate document processes and customer onboarding– thus improving customer interactions.

2. Automated loan processing

AI can fully automate loan processing, eliminating administrative overhead and enabling faster disbursements.

According to McKinsey, AI-augmented RPA platforms can resolve up to 60% of credit-desk exceptions end-to-end, compared to just 20% historically, showing how automation streamlines complex lending processes.

- Credit scoring and loan underwriting: ML models, trained on amounts of historical loan data, analyze the credit score and other application details (debt-to-income ratio, types of credit used, etc.) to evaluate the risk of lending money to a borrower.

- Asset evaluation: For mortgage lending, AI can automate property appraisals by analyzing listing data and imagery and comparing them with peer valuations.

- Policy adherence: AI models also scrutinize documents to ensure that KYC and lending policies are met before approval.

- Fraud detection: By understanding patterns from past fraud cases, AI flags potentially dubious loan applications for review.

Lending startups like Upstart use AI at every step of the lending process. It allows applying for a fast personal loan, auto refinancing, or debt consolidation– all online.

Simform developed an online P2P (peer-to-peer) lending platform

It directly connects borrowers with individual investors, sidestepping traditional intermediaries like banks.

We used TrueLayer’s open banking API to integrate with various banks and enable secure transactions. Additionally, it supports SCA as required by PSD2 regulations. We employed microservices to efficiently manage critical modules such as loan calculations, affiliation processes, and user verification. VPN ensured secure communication between these modules, making it a highly responsive and reliable system.

We also built robust compliance frameworks, including the Financial Conduct Authority (FCA), to handle the complex regulatory landscape, ensuring timely updates and adjustments in response to new FCA directives.

3. Underwriting and claims management

In insurance, underwriters evaluate risk factors associated with prospective clients and coverage types to determine policy terms and pricing. This complex process involves analyzing large datasets on customer profiles, health records, etc.

Intelligent underwriting

ML models trained on these historical data can accurately quantify risks and automate underwriting decisions, at least for low-risk cases.

Precision pricing

For higher customer satisfaction and retention, you can offer tailored pricing instead of broad demographic-based pricing. AI aids this with:

- Granular risk modeling: Processing large multi-dimensional data sets including behavioral data, market indicators, etc., to produce highly granular and precise risk quantification.

- Dynamic pricing: Using AI recommendation engines that adjust pricing elements (e.g., premiums, interest rates, fees) in real-time based on the specific risk profiles.

- Forecasting impact: Forecasting impact of pricing strategy on critical metrics like market share, customer churn, and profit margins to optimize the pricing structure.

This approach is similar to some of the “individualized data” use cases of AI in insurance. For instance, Progressive, a leading insurance company in the USA, collects data about individual drivers to predict their risk of accidents better.

Another example is CAPE Analytics, a computer vision startup that turns geospatial data into actionable insights to optimize the underwriting process for home insurers.

Simform developed a telematics-based solution for Scandinivia’s largest insurer, Tryg.

It uses ML for real-time predictive analytics based on data collected from fleet sensors. It helps find emerging vehicle health issues for downstream processing, such as insurance claims.

How Tryg reduced operational costs by 50%

4. Automated bookkeeping and accounting processes

Bookkeeping and accounting processes like recording transactions, reconciling accounts, etc., are highly data-intensive with substantial scope for manual errors. AI can automate these tasks, increase accuracy, and enable employees to focus on higher-value tasks.

| Use case | AI application |

| Data entry | AI technologies like OCR and NLP can help extract data and then populate it into accounting software or databases. |

| Transaction classification | AI can automatically categorize transactions (deposits, withdrawals, transfers) based on keywords, names, and past spending patterns. |

| Account/transaction reconciliation | AI can automatically match bank statements with internal records or other external sources based on various criteria. |

| Financial reporting | AI can automate the process of compiling data from various sources, like accounting systems, ERP, and CRM, to produce reports quickly in the required format. |

Simform developed an integrated platform for accounting, invoicing, and payments

The app facilitates comprehensive invoicing management, allowing efficient handling of invoices and payment requests. It seamlessly integrates with both internal and external ERPs such as QuickBooks, Xero, and Sage. We leveraged React for highly responsive web interfaces and employed React Native with Expo for a seamless cross-platform experience.

We also integrated a Gen AI-based chatbot so that customers can use natural language to inquire about banking and transaction-related information such as transaction and balance queries, product information, service requests, etc.

5. Data-driven client acquisition and churn prediction

Going beyond optimizing front-office and back-office operations, AI in fintech can also aid marketing and sales efforts for growth and profitability.

Targeted campaigns for customer acquisition

AI’s ability to prioritize leads with predictive lead scoring and segment customers into highly granular micro-clusters based on behavior, needs, and preferences allows for the creation of highly targeted marketing strategies.

Churn prediction

For existing customers, AI models can forecast churn months in advance based on usage patterns, sentiments, demographics, and other factors. This enables proactive retention strategies.

Predictive analysis for tailored customer experience

AI-powered predictive analysis facilitates tailored customer experiences by understanding behavior patterns through transaction histories, product usage, call/clickstream data, and CRM records.

We use supervised and unsupervised learning to create predictive models for forecasting individual customer behaviors and needs, identifying impending events or actions. AI recommendation engines then tailor the customer experience by suggesting products/offers, ideal outreach times/channels, and optimizing cross-sell/upsell opportunities.

6. Biometric security and authentication

Traditional identity verification methods, such as PINs, passwords, and security questions, are vulnerable to cyber-attacks and hacking. AI can enable robust security and authentication for various purposes, such as onboarding and logins.

For example, HSBC’s Voice ID allows you to access phone banking with your voice. It uses advanced voice biometric technology to verify your identity with your unique voice.

| Technology | Application |

| Facial recognition | Facial images captured during user logins are matched in real-time against archived photos from identity documents using AI models |

| Voice recognition | Users can be authenticated by having AI analyze characteristics of their voice like speech patterns, pronunciations, accents, etc. |

| Fingerprint/palmprint | AI enables accurate fingerprint/palmprint authentication by extracting and matching unique patterns like ridges, valleys, and minutiae points |

| Behavioral biometrics | AI models can analyze how users physically interact with their devices– typing patterns, swipe gestures, pressure applied, and more, which form unique user profiles |

B. Risk management

7. Credit risk assessment and loan prediction

Due to their inherent big data nature, credit risk assessment and loan prediction are the most notable AI in fintech examples.

AI models can process alternative data sources like social media, mobile footprints, and browser histories to gain a comprehensive view of an individual’s financial behavior. Using techniques like neural networks, decision trees, and clustering algorithms, AI can discover highly complex patterns and interrelationships across hundreds of data dimensions correlating with credit risk.

Moreover, as new data accumulates, model retraining can ensure their predictive capabilities adapt to evolving market conditions, consumer behavior trends, and other dynamics that influence risk.

Major payment networks use AI for fraud detection and risk scoring. Visa analyzes over $11 trillion in annual transactions to block billions in fraud, and Mastercard’s Decision Intelligence prevents up to $20 billion each year with real‑time risk scoring.

Upstart uses sophisticated ML algorithms to tease out relationships between variables, including unconventional ones such as colleges attended, area of study, GPA, etc., to assess creditworthiness. This improves credit access for all and at the right price.

ZestFinance is another fintech startup using AI to process alternative data to assess so-called “thin file borrowers”– who have little or no credit history. It provides companies with tools to build tailored underwriting models that can spot good borrowers overlooked by national credit scores.

Even large corporations like Wells Fargo are using AI models to consider alternative data points to assess applicants’ creditworthiness.

8. Fraud detection and prevention

Financial fraud can result in billions of dollars in losses annually for financial services companies. However, traditional methods cannot keep pace with rapidly evolving fraud tactics. AI offers a more sophisticated and proactive approach:

- AI and ML models can be trained on huge datasets with details of past fraud cases across various channels– online banking, mobile apps, in-person visits, etc. The models then identify intricate patterns and indicators that may signal fraudulent activities. In cases of suspected fraud, AI systems can automatically block high-risk transactions while prompting further security steps, such as added verification.

- Using recurrent neural networks (RNNs) for anomaly detection, AI systems continuously monitor all transactions and user activities to flag any deviations from expected “normal” behavior baselines. These can include sudden changes in location, transaction frequency, amounts, payee details, etc. Advanced AI models combine techniques like neural networks, fuzzy logic, and Bayesian filters to accurately detect potential fraud based on hundreds of risk indicators like IP addresses, device fingerprints, user behavior traits, and more.

- Banks like JPMorgan use synthetic data to improve fraud detection. By creating realistic fake transactions, they can train and test AI models without using real customer data, speeding up development and making models stronger against different fraud tactics.

- AI also adapts to evolving fraud patterns, continuously learning and improving its ability to detect new threats in real-time.

For instance, American Express runs deep learning-based models as part of its fraud prevention strategy. Their fraud algorithms monitor every transaction around the world in real time (more than $1.2 trillion spent annually) and generate fraud decisions in milliseconds.

9. Market analysis and investment risk management

Financial markets are largely driven by news, events, market sentiments, and multiple economic factors. By analyzing vast historical and current data using complex models, AI systems predict future risks more accurately than conventional methods.

For instance, NLP can rapidly analyze massive volumes of unstructured data sources like news reports, social media, analyst reports, company filings, etc., to extract signals about market movements, trends, and risks.

These insights, combined with quantitative data, can be used to build sophisticated predictive models. Predictive market modeling can forecast future market behavior, like stock prices or economic trends.

Additionally, AI-powered stress testing and scenario planning can simulate how financial institutions or investments might perform under various adverse economic conditions, such as recessions, market crashes, booms, or specific events.

HSBC developed an innovative tool for its traders and risk management teams. The AI-powered tool can run multiple what-ifs on market scenarios that could impact the trading book so they can take mitigating actions if the numbers are outside their risk appetite. It gives results in minutes!

C. Customer service

10. AI-powered virtual assistant chatbots

Generative AI in fintech is becoming increasingly popular with assistant chatbots, particularly in banking. Some noteworthy examples include Bank of America’s virtual assistant Erica, Capital One’s chatbot named Eno, Wells Fargo’s bot Fargo, and Zurich Insurance’s Zara.

AI-powered chatbots allow customers to self-serve hassle-free for common queries and transactions, reducing wait times. Meanwhile, human agents can focus on more complex issues requiring empathy.

Using NLP and natural language understanding (NLU), they can interpret customer queries expressed in conversational language across multiple channels, such as websites, mobile apps, messaging platforms, etc. NLU can also allow chatbots to determine the underlying intent, e.g., checking account balances, disputing transactions, etc.

In addition, AI chatbots can connect with core banking systems, authentication protocols, and knowledge bases to execute tasks, retrieve updated information, and provide relevant responses. They can also learn from past interactions to enhance their responses in the future.

JPMorgan Chase rolled out an AI-powered virtual assistant to easily enable its corporate clients to move money around the world, whether for routine payroll or multi-million-dollar mergers and acquisitions.

11. Personalized financial guidance

One-size-fits-all financial advice cannot accommodate the diverse circumstances and goals of customers. Ai helps financial institutions provide more customized guidance by:

- Building “advice engines” that use machine learning to recommend personalized and optimized strategies across domains like investments, taxation, insurance, and more.

- Using predictive analytics to anticipate life events and adjust recommendations accordingly.

- Continuously learning and updating recommendations based on evolving circumstances and goals.

Beyond rigid automation, AI’s adaptive capabilities enable hyper-personalized, contextualized advice that maximizes financial outcomes while minimizing risks and opportunity costs.

Robo advisors

Robo-advisors, like Betterment, are automated investment platforms that use AI algorithms to manage your money. They analyze data and adapt investment strategies to fit your financial goals, which you provide.

While it automates investing, it also costs less than working with a traditional investment manager, which translates to more savings.

D. Payments systems

12. Voice-enabled payments

With AI-powered voice interfaces, customers can now initiate payments and money transfers securely using just voice commands.

AI systems use NLP to accurately interpret voice payment instructions. Voice biometrics verify the user’s identity by analyzing over 100 unique voice characteristics against a pre-recorded voice print. After authentication, the AI system securely communicates the payment instructions to the bank’s core systems to initiate the financial transaction.

This enables a seamless, hands-free payment experience across mobile apps, smart home assistants, and in-car systems, boosting accessibility and convenience.

Simform developed a voice-enabled smart wallet for safekeeping of credit/debit cards

We built a smart wallet product by leveraging biometric, IoT, and cloud technologies with an accompanying mobile app solution. We established a stable and secure connection between the device and the app with Bluetooth Low Energy (BLE). The connection was made exclusive and highly secure by implementing the GATT profile setup.

To enhance mobile security, we performed extensive security audits to ensure no application module was vulnerable to attacks. We also secured the data using different standards, such as HTTP protocols, AES-256 Encryption, and voice authorization.

13. Facial recognition for frictionless payments

Facial recognition powered by computer vision can enable frictionless, more secure payments.

An AI facial recognition engine securely stores and digitizes users’ facial biometrics (captured via mobile or webcam) into a compact numerical representation. While making payments, the user’s live face is matched against their enrolled template by detecting numerous distinct facial landmarks and patterns for authentication.

This allows logging into payment apps and authorizing transactions with just a glance at the camera, delivering a frictionless experience far more secure than passwords/PINs.

J.P. Morgan is piloting biometrics-based payments with select retailers in the U.S. It includes palm and face identification for payment authentication in-store and works on an enrol-capture-authenticate-pay basis.

E. Trading and investment

14. Algorithmic trading

Also known as algo trading, it is one of the most popular applications of AI in fintech to rapidly identify and capitalizing on lucrative trading opportunities.

AI algorithms can analyze vast amounts of data, such as real-time news, research reports, and more, to generate tradable market signals at lightning speeds. Advanced AI models like deep neural networks can detect intricate patterns and relationships across millions of data points that serve as reliable indicators of upcoming price movements.

Once an opportunity is identified, AI systems can automatically execute the optimal trade order by self-adjusting parameters like order sizing, timing, etc., while adhering to risk management constraints.

High-frequency trading

By rapidly iterating through the above workflows in milliseconds, AI can also enable high-frequency, low-latency trading strategies to capitalize on minuscule market inefficiencies for more profits.

Use reinforcement learning (RL) bots to adjust portfolios and improve strategies in real time. For example, DDPG-based models delivered 14.12% annual returns and Sharpe Ratios about 33% higher than traditional methods, outperforming Buy-and-Hold and Universal Portfolio strategies.

Renaissance Technologies is widely considered one of the most successful firms in using algorithmic trading. Their flagship fund, the Medallion Fund, has an impressive track record with average annual returns of 66% since 1988.

15. Portfolio management optimization

AI can aid portfolio management optimization in many ways to drive better returns while adhering to risk tolerance levels.

Asset selection modeling

AI algorithms process massive amounts of data from various sources to build sophisticated predictive models that forecast the future risk and return characteristics of individual assets or asset classes. It makes asset allocation efficient and accurate.

More advanced models allow for dynamic asset allocation, which adjusts investments based on changing market conditions rather than sticking with a fixed strategy.

Portfolio construction

Using techniques like mean-variance optimization, AI systems recommend the ideal portfolio weightings across asset classes based on the client’s investment policy, targets, constraints, and risk preferences. As market conditions evolve, AI dynamically adjusts and rebalances the portfolio strategy by reinvesting dividends, reducing exposure to underperformers, and buying into potential opportunities proactively.

Quantum-enhanced optimization

Use hybrid quantum-classical algorithms to solve complex portfolio optimization problems and run Monte Carlo simulations up to 10× faster than traditional methods.

F. Audit and compliance

16. Regulatory compliance

RegTech, a rapidly growing field, uses AI and other technologies to automate compliance processes for banks and financial services, which face ever-changing and complex regulatory requirements.

- Regulatory parsing: Using NLP, AI systems can parse through regulatory documents to identify specific policy obligations and requirements.

- Compliance risk monitoring: AI models monitor transactions and activities to flag potential violations or gaps before they escalate into penalties.

- Automated reporting: AI automates compiling and formatting compliance data and insights into standardized reports mandated by regulatory bodies for regular submissions.

This allows firms to manage compliance more efficiently, reducing costs associated with hiring experts and manual documentation.

In a unique application, Wells Fargo is using large language models (LLMs) to help determine what information clients must report to regulators and how they can improve their business processes.

17. Anti-money laundering (AML) automation

Detecting and preventing money laundering is another key obligation for banks and finance companies. Intelligent automation powered by AI can monitor transactions and flag suspicious patterns.

AI links seemingly disparate entities and transactions, helping uncover complex money laundering networks. Further, through NLP, matching entities and identities across multiple data sources with different spellings or aliases helps detect criminal relationships. AI can also screen customers and transactions against global sanctions and enforcement lists in real time to prevent dealings with bad actors.

HSBC trained Google Cloud’s AML AI on its vast range of customer data to spot suspicious activities with more precision than manual optimization. It identifies 2-4x as much suspicious activity as its previous system while reducing the number of alerts by 60%.

G. Advanced analytics

18. Market sentiment analysis

Market movements are heavily driven by factors like news events, social media narratives, public perceptions, and investor sentiments– which are difficult to quantify. AI aids this through NLP, semantic analysis, and predictive modeling.

Using techniques like neural tensor networks and topic modeling, AI can also quantify qualitative sentiments into coherent numerical representations to enable quantitative analysis. This holistic view allows traders and fund managers to understand market drivers better and craft strategies proactively.

Simform developed a sentiment market analytics engine for portfolio managers

SenTMap is an advanced research tool built with a scalable real-time analytics engine that can perform analysis based on real-time news data to determine trends in sentiments and stock price movements.

To display sentiments in a way that required minimum visual processing, we built highly customized 3D charting capabilities with heat maps. More complicated implementations involved integrating geometries, lighting, and data mesh. To build Treemaps, we utilized squarified treemapping algorithm, which is widely accepted by a broad audience, especially in financial contexts.

Explore the full SenTMap case study

19. Forecasting

Accurate forecasting of market indicators, asset prices, consumer demand, and other financial metrics is critical for strategic decision-making. AI enables this through:

- Time series modeling: AI employs advanced techniques like ARIMA and LSTM neural networks to analyze historical time series data, identifying complex patterns and trends for future forecasts.

- Multivariate analysis: AI examines how multiple independent variables, such as economic indicators, news sentiments, etc., interact and influence the target metric being forecast.

- Ensemble modeling: By combining multiple models, AI can factor in diverse data signals to produce more reliable and resilient forecasts than single models.

- Probabilistic forecasting: Rather than point estimates, AI can generate probabilistic forecasts with confidence intervals to quantify uncertainty and risk.

For instance, banks can use AI forecasting models to estimate future loan default rates to better measure risk exposure and provision capital reserves adequately.

Simform implemented geospatial price forecasting for informed real estate investment

The platform enables seamless investment and trading of commercial, residential, and institutional properties, allowing users to own fractions and earn dividends through rental income.

We implemented price prediction leveraging ML algorithms, focusing on geographical factors such as places and zip codes. We used housing market data from Redfin to enrich the prediction model. We also implemented time series forecasting using ARIMA (AutoRegressive Integrated Moving Average) and SARIMA (Seasonal ARIMA) algorithms. These were instrumental in capturing and predicting patterns in real estate price data, ensuring a nuanced and accurate prediction.

These use cases demonstrate AI’s significant benefits for financial institutions. But deploying them successfully is not without its hurdles.

Common challenges for implementing AI in fintech

While AI offers immense potential in fintech, organizations face several challenges in effectively implementing and scaling AI solutions.

1. Lack of quality data and access

AI models rely heavily on the quality and quantity of data for training to deliver accurate results. However, in finance, data is often stored in siloed databases in unstructured formats, making it difficult to access, integrate, and prepare for AI use cases.

Data drift is another significant challenge. Many AI models in fintech are initially trained on historical data, which can lead to performance degradation if the statistical characteristics of the data change over time.

New fraud vector: In early 2024, dark‑web trading of AI‑powered deepfake kits spiked by 223%, creating fresh risks of synthetic‑identity and document‑forgery attacks.

Potential solutions: Establish robust data governance, metadata management, and data integration pipelines. Use APIs to automatically get fresh data from different sources and build a custom storage solution for quickly and efficiently retrieving historical and new data in the required format.

For addressing data insufficiency, synthetic data generation techniques can be used to imitate the characteristics and patterns of real-world data to augment the available dataset, providing additional samples for training and improving model performance.

2. Stringent and constantly evolving regulatory compliance

The financial sector is heavily regulated, with stringent rules around data privacy, security, model transparency, ethical practices, and audit trails. Fines for non-compliance can be massive, and ensuring that AI solutions adhere to these rules is a significant hurdle.

Moreover, concerns about AI’s “black box” nature today make it challenging to explain results and instill confidence, especially for high-stakes decisions like lending approvals or insurance underwriting.

Beyond GDPR & CCPA, new regimes like the EU’s AI Act, the UK’s proposed AI rules, and multiple data‑localization laws now demand multi‑jurisdictional oversight of every model.

Potential solutions: Follow model governance frameworks like OMRM by embedding compliance checks into the AI lifecycle, starting from the design phase. We also recommend collaborating closely with legal and compliance teams to validate AI models’ compliance with relevant guidelines.

Moreover, adopt explainable AI techniques that enable traceability into model decision-making logic. Ensure human oversight for AI systems handling critical processes and use simplified machine learning techniques like decision trees that are more interpretable.

3. Bias from training data

In 2019, Apple Card was investigated for claims that its credit assessment algorithm was gender biased against women. But inherent or not, it was a violation.

AI models can inadvertently perpetuate and amplify historical biases in training data related to gender, race, income levels, etc. If the training data reflects discriminatory patterns from the past, it can lead to unfair outcomes, such as for lending.

Regulators now require formal algorithmic impact assessments and periodic third‑party audits for any model used in credit, insurance or trading.

Potential solutions: Implement bias testing as part of model validation. Use debiasing techniques like adversarial debiasing, counterfactual evaluation, reweighing training data, and discrimination-aware data mining to mitigate bias.

When not to use AI in fintech

While AI offers immense value, there are certain scenarios where traditional approaches or human expertise may be more suitable. To name a few, here are some scenarios:

- Highly regulated processes requiring full auditability and rules transparency

- For niche products/services with low data volumes inadequate for model training

- For high-stakes decisions carrying severe repercussions

- Rapidly changing environments where AI can’t adapt quickly enough

- When interpreting nuanced legal/regulatory requirements that require human reasoning

- Customer-facing roles that involve emotional support during crises/disputes

- Forecasting impacts of black swan events that deviate from past patterns

- Creative strategy or M&A advisory, where nuanced judgment and cross‑market expertise outperform any model.

- Highly bespoke, low‑volume products, where training costs dwarf potential benefits.

- Customer‑facing roles demanding deep human empathy (e.g., grief counseling) where AI risks cold‑comfort.

The future of AI in fintech

AI has already made deep inroads across banking, lending, investing, insurance, and payments. However, this is just the start. As AI capabilities like LLMs, autonomous agents, and edge AI evolve further, we can expect more paradigm shifts:

- Autonomous finance where AI drives end-to-end decision flows with limited human intervention

- Hyper-personalized banking with AI assistants understanding unique contexts and needs

- AI-native fintechs disrupting business models and democratizing access to financial services

- AI-powered predictive risk analysis and dynamic pricing at an individual level

- AI co-pilots augmenting human expertise and capabilities across financial roles

- Agentic AI & autonomous agents negotiating interbank settlements and managing treasury flows without human triggers.

Most projections estimate AI to be a multi-trillion-dollar annual opportunity. As the technology matures, fintech innovation will accelerate, transforming how we bank, invest, insure, and manage money.

Deploy innovative fintech AI solutions with Simform

At Simform, we have extensive experience developing AI and ML solutions for the finance industry. We partner with you to harness the power of AI by:

- Conducting comprehensive requirements analysis to identify high-impact AI use cases within your processes

- Developing highly accurate custom AI/ML models tailored to your unique needs

- Ensuring seamless integration of these models with your existing technology landscape and databases

- Providing ongoing monitoring, model retraining, and performance optimization as your needs evolve

- Leveraging our BFSI domain proficiency to navigate challenges around regulations, security, and compliance

With our proven AI capabilities and finance industry expertise, Simform can accelerate your digital transformation journey and unlock AI’s full potential for your organization. If you are looking to enhance your fintech solutions with AI/ML technologies, contact us today!

CHINTALAPATI SUBRAMANYAM

In the context of stringent regulatory control the areas where AI FinTech is not appropriate is rightly identified. But many countries central banks have not evolved cyber crimes and fraud control mechanism as it is roughing great challenges. everyday. yet, we can come out with solutions to minimize financial frauds with improved alert systems. AI can contribute significantly. You have a great journey ahead to bring out robust solutions in the near future. Subramanyam