Share State: An online lending platform for borrowers and lenders

Category: AWS Financial Services

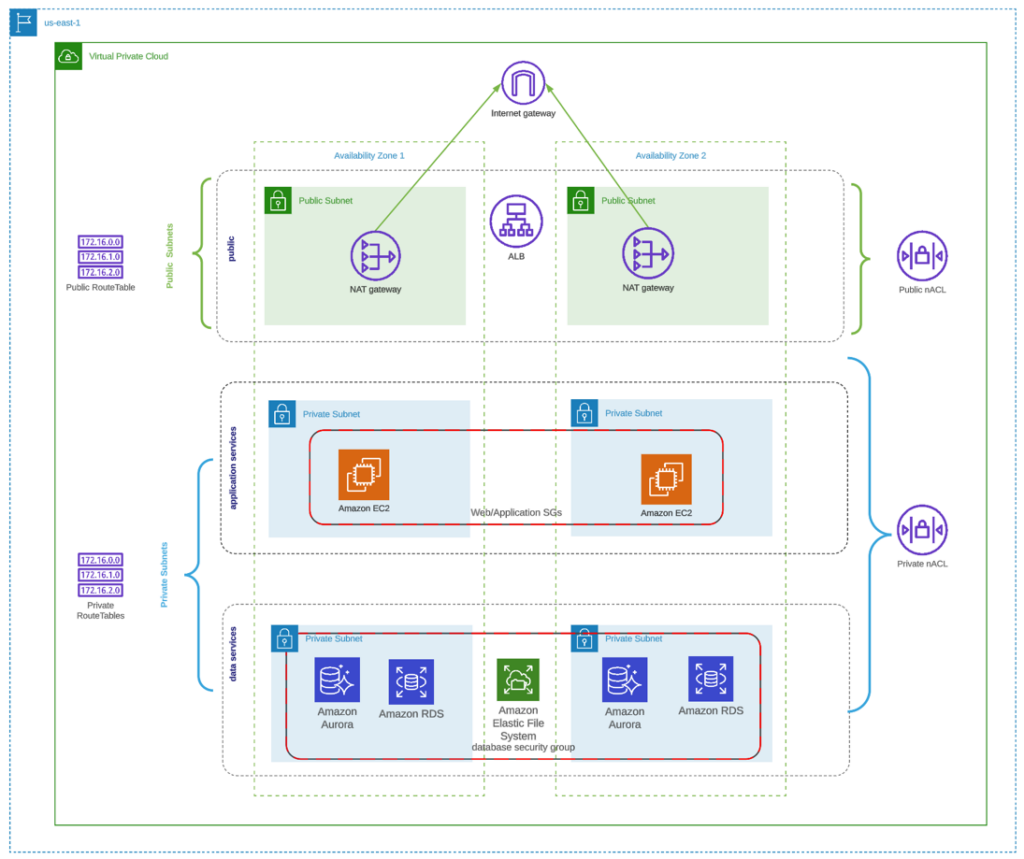

Services: AWS RDS, AWS EC2, AWS EFS, AWS ALB, AWS S3, AWS CloudWatch

Category: AWS Financial Services

Services: AWS RDS, AWS EC2, AWS EFS, AWS ALB, AWS S3, AWS CloudWatch

Share State is a private lender that provides competitive loans for various stages of real estate projects across the United States. It has built a portal where borrowers and lenders can register for a streamlined lending process. Share State also provides features to track the status of loans in which you are partnering.

We do not collect any information about users, except for the information contained in cookies. We store cookies on your device, including mobile device, as per your preferences set on our cookie consent manager. Cookies are used to make the website work as intended and to provide a more personalized web experience. By selecting ‘Required cookies only’, you are requesting Simform not to sell or share your personal information. However, you can choose to reject certain types of cookies, which may impact your experience of the website and the personalized experience we are able to offer.

We use cookies to analyze the website traffic and differentiate between bots and real humans. We also disclose information about your use of our site with our social media, advertising and analytics partners. Additional details are available in our Privacy Policy.

These cookies are necessary for the website to function and cannot be turned off.

Under the California Consumer Privacy Act, you may choose to opt-out of the optional cookies. These optional cookies include analytics cookies, performance and functionality cookies, and targeting cookies.

Analytics cookies help us understand the traffic source and user behavior, for example the pages they visit, how long they stay on a specific page, etc.

Performance cookies collect information about how our website performs, for example,page responsiveness, loading times, and any technical issues encountered so that we can optimize the speed and performance of our website.

Targeting cookies enable us to build a profile of your interests and show you personalized ads. If you opt out, we will share your personal information to any third parties.