Share State: An online lending platform for borrowers and lenders

Category: AWS Financial Services

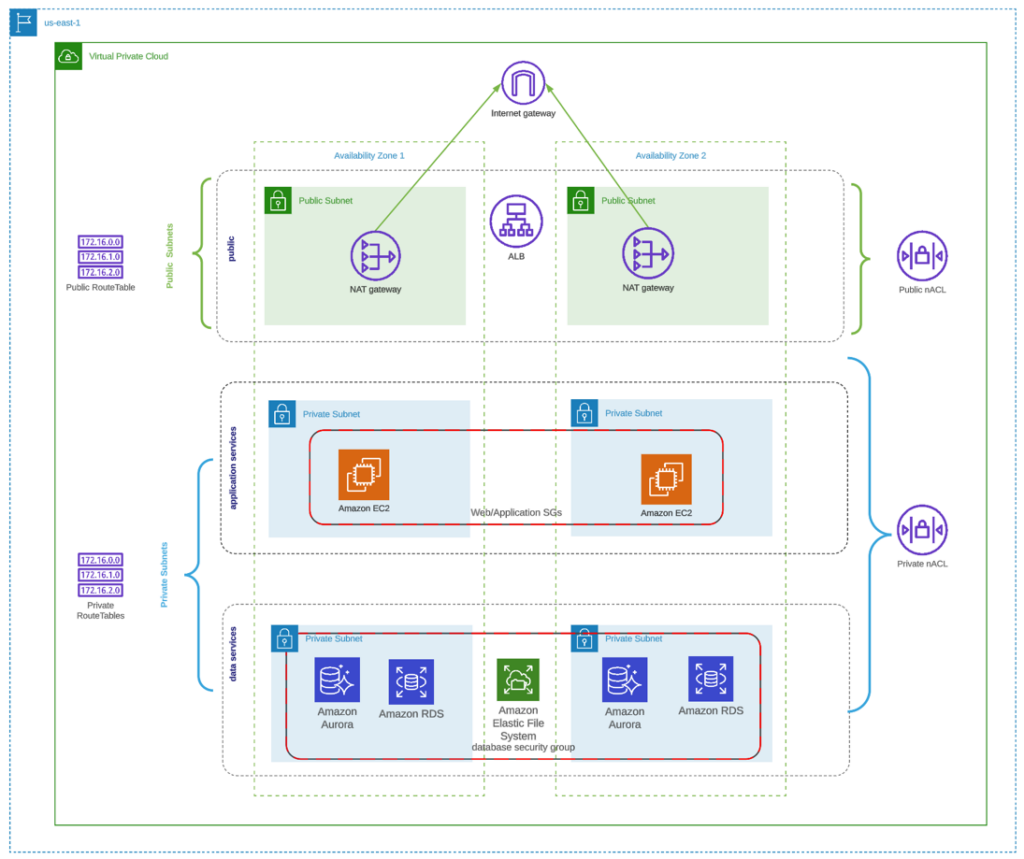

Services: AWS RDS, AWS EC2, AWS EFS, AWS ALB, AWS S3, AWS CloudWatch

Category: AWS Financial Services

Services: AWS RDS, AWS EC2, AWS EFS, AWS ALB, AWS S3, AWS CloudWatch

Share State is a private lender that provides competitive loans for various stages of real estate projects across the United States. It has built a portal where borrowers and lenders can register for a streamlined lending process. Share State also provides features to track the status of loans in which you are partnering.