Zenda: A platform to manage medical expenses

Category: Financial Management

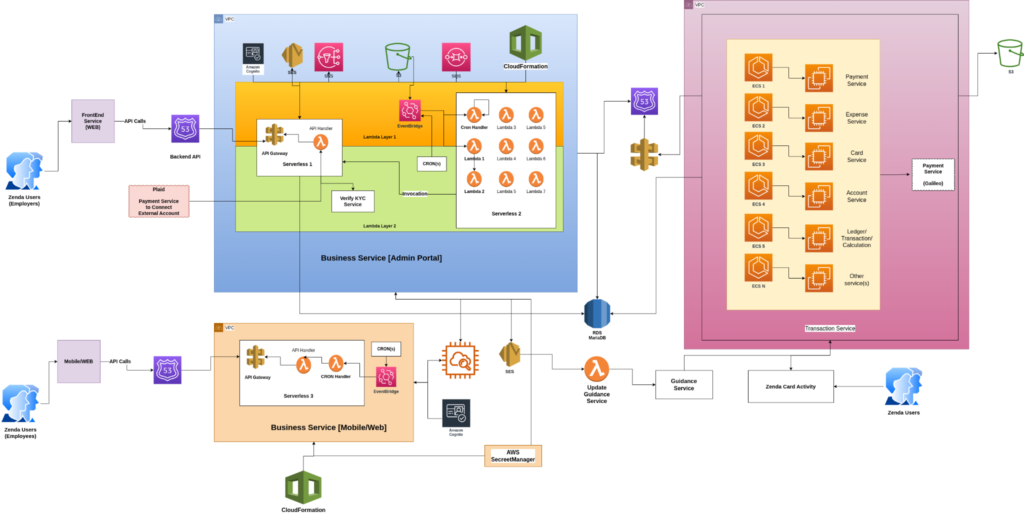

Services: AWS Lambda, Amazon RDS, Amazon API Gateway, AWS CloudFormation, and Amazon Eventbridge

Category: Financial Management

Services: AWS Lambda, Amazon RDS, Amazon API Gateway, AWS CloudFormation, and Amazon Eventbridge

Zenda is a platform that helps employees categorize and track medical expenses for enhanced payment management. It allows corporate employees to track medical costs, manage payments, and save money. Zenda ia a leading financial management platform for employees in an organization to track all the transactions, and manage payments.