The Money Platform: A Peer-to-Peer Lending Marketplace

Category: Fintech

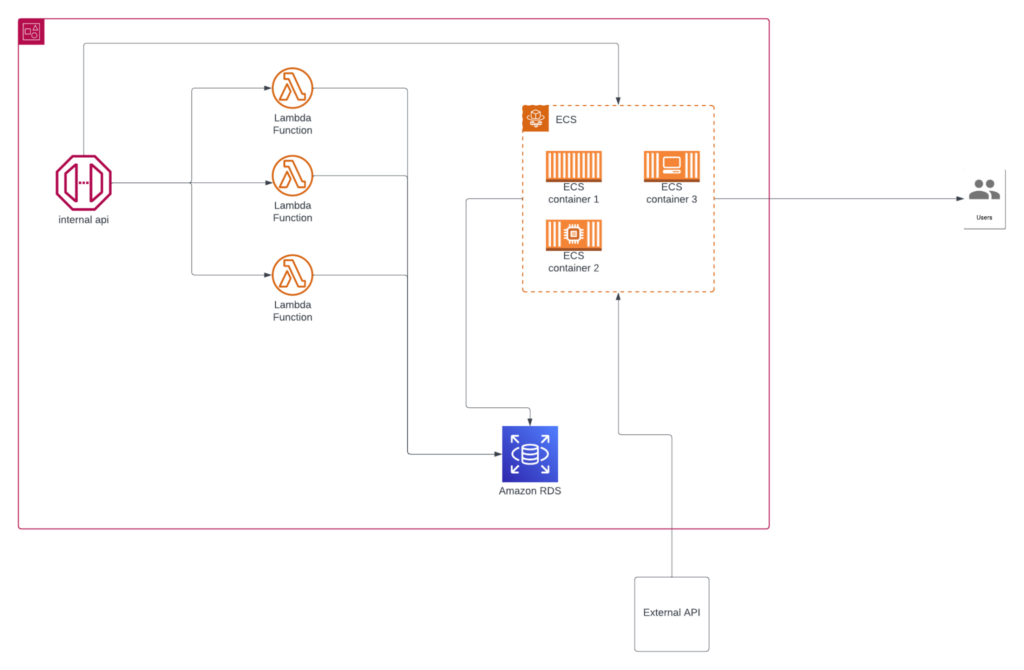

Services: AWS Aurora, Amazon API Gateway, Amazon ECS, AWS Lambda, and Amazon KMS

Category: Fintech

Services: AWS Aurora, Amazon API Gateway, Amazon ECS, AWS Lambda, and Amazon KMS

The Money Platform is a UK-based peer-to-peer lending marketplace connecting lenders with borrowers for short-term personal loans. The Money Platform offers a clear and uncomplicated path to fair credit for the millions of individuals in the UK who are currently excluded from the credit system. It has designed a TMP score which analyzes each individual’s financial status and then decides whether to lend money or not.